Brendan Daley, Brett Green, Victoria Vanasco

Based on: Journal of Finance, 2020, 75(2), 1037-1082, DOI: https://doi.org/10.1111/jofi.12866

What is the economic role of credit ratings in the market for consumer loans? In recent years, this question has come under intense debate. One intuition is that credit ratings alleviate information asymmetries between lenders and investors. A second intuition is that credit ratings impose discipline on lenders, thereby inducing them to make better investment decisions. While the first intuition is correct, the second intuition plays out in surprising ways, and even accurate ratings may fail to improve lending decisions.

After originating a new consumer loan, a bank faces a choice: hold the loan on its balance sheet (i.e., accept the risk of default and receive the loan repayments) or securitize the loan (i.e., sell the rights to the repayments). The bank’s benefits from securitization include offloading risk to investors and replenishing capital, allowing additional loans. Over the past few decades, securitization has grown increasingly important in credit markets and now constitutes a large fraction of overall credit. For instance, in consumer lending markets (e.g., mortgages, student loans, auto loans, and credit card debt), between 30% and 75% of loans are securitized.

Securitization, however, is not without challenges. First, investors understand that lenders have better information about the loans they are selling (i.e., there is adverse selection). Second, securitization may weaken banks’ incentives to screen borrowers (i.e., there is also moral hazard).

How might a bank assuage investors’ concerns about the quality of the loans they are buying? One option is for the bank to retain a portion of the loans it originates in order to signal confidence in their quality. Such a signal is credible precisely because it is costly: it ties up a portion of the bank’s capital. A second option is for a credit-rating agency to rate the quality of the bank’s loan pool. Obtaining a rating is less costly for the bank than retaining loans, but the rating is only an imperfect proxy for the loan pool’s quality. Of course, these two options are not mutually exclusive.

First, consider a world without credit ratings. In this case, the only way for the bank to assuage investors is to retain some loans. Because this is costly for the bank, it has a lower incentive to issue loans. Hence, lending standards will be too high, and credit too scarce.

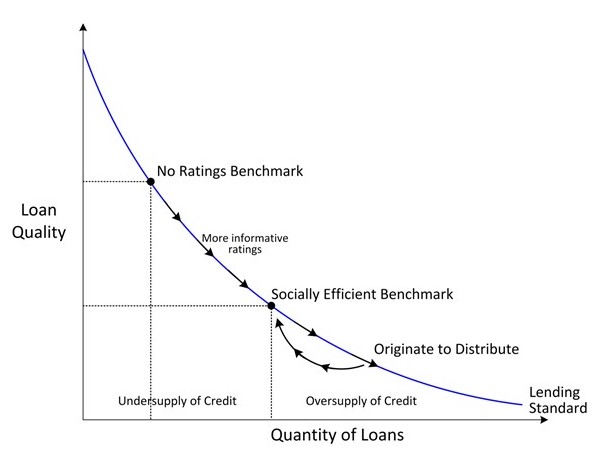

When credit ratings are available and trusted, the bank retains fewer loans. In essence, when ratings are introduced, the market shifts from a signaling-through-retention regime toward an originate-to-distribute regime in which banks sell the loan they originate. The more accurate are ratings, the larger is this shift. However, because fewer loans are retained, reliance on ratings actually reduces banks’ lending standards. If all loans are sold, as in a pure originate-to-distribute regime, the lending standard is extremely low, and there is an oversupply of credit.

Figure 1: The blue curve represents the available loan opportunities in the economy (higher lending standards along the vertical axis imply fewer loan issuances along the horizontal axis). The arrows indicate the credit market outcome with increasing ratings accuracy: moving from an undersupply of credit to an oversupply in the originate-to-distribute regime. Naturally, if ratings became perfectly informative, both the adverse selection and moral hazard problems would be eliminated, and the market would function perfectly.

There are two implications for overall efficiency. First, ratings reduce the need for banks to incur the cost of retaining loans to signal the quality to investors. Second, precisely because of this reduced reliance on retention, ratings weaken the incentives of the bank to screen borrowers. Therefore, ratings increase overall efficiency only if the benefits of reduced retention outweigh the cost of originating bad loans. Often, these benefits do in fact outweigh the costs. In particular, the benefits necessarily outweigh the costs when banks are good at identifying bad loans (despite their increased incentive to originate them). And, of course, perfectly accurate ratings would deliver fully efficient market outcomes.

The above arguments rely on investors understanding the true accuracy of ratings. Instead, if ratings are inflated, and banks know this before investors do, then lending standards will collapse and investors will be left holding the bag on low-quality (but highly rated) securitized loans.

What policies should regulators adopt? An intuitive and often proposed regulation is to require that banks retain a fraction of all their originated loans. Proponents argue that this would provide banks with incentives to make good loans by ensuring that they have some “skin in the game.” Critics argue that, because retention is costly for the bank, such regulation may reduce the availability of financing. The proponents’ argument is most convincing when ratings are accurate and credit is oversupplied. However, when ratings are inaccurate, originating banks are already retaining some loans, and credit is scarce, the critics’ concern carries more force.

Central banks also attempt to spur lending by lowering bank funding rates. Such attempts can backfire. Reducing banks’ funding rates makes it cheaper to signal loan quality through retention, leading to more retention and less origination.

To conclude, in the market for consumer loans, the benefits of securitization are diminished by two classic economic problems: adverse selection in the market for the securities and moral hazard in the market for loan origination. Credit rating accuracy, loan retention rules, and funding costs all affect the interplay of these two problems. For instance, while credit ratings mitigate the adverse selection problem, they may also cause banks to originate too many bad loans. The efficacy of a given policy proposal hinges on which of the two problems is more acute in a particular market environment.

Ralph S. O'Connor Associate Professor

Johns Hopkins University. Department of Economics and Center for Financial Economics